+91 8929515515

Call US

Simplifying Banking with Smarter BFSI Communication

Seamless, Fast Digital Onboarding for the BFSI Industry

- Delivering a frictionless digital onboarding journey for the BFSI sector, with an advanced communications platform tailor made for the banking and financial services.

- Simplified KYC, secure documentation, instant support using conversational channels such as WhatsApp, SMS, and RCS messaging.

- Target lower drop-offs, ensures compliance, and delivers a superior, secure, and efficient onboarding experience for today’s digital-first banking customers.

Innovative Solutions

Innovation That Moves Your Communication Forward

Dedicated Support

Dedicated Support for Your Challenges and Growth.

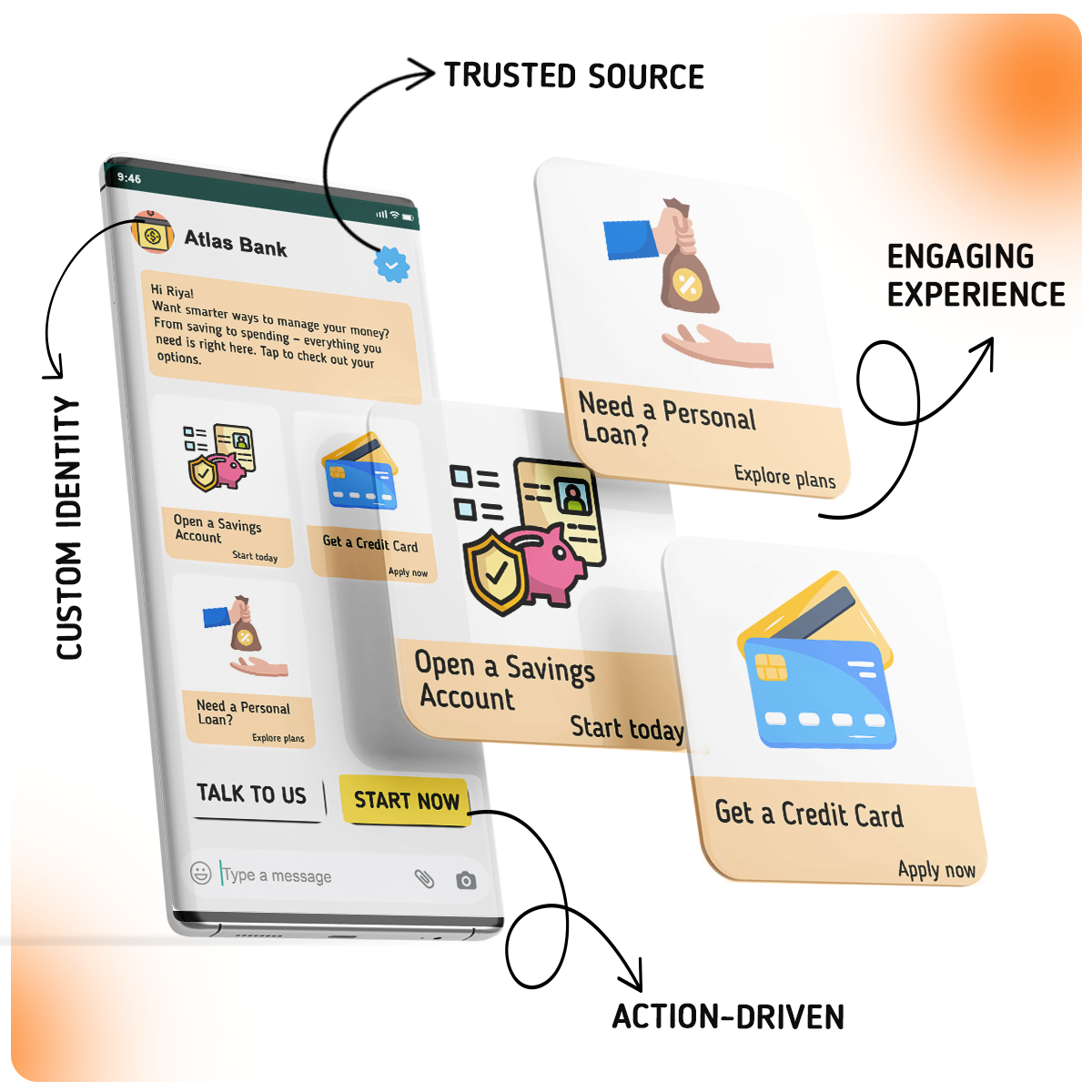

Boost Revenue with Chat-Based Transactions

- Simplify EMI payments, deposits, and other bill payments for the BFSI industry through conversational channels like WhatsApp and RCS messaging.

- Our WhatsApp solutions for BFSI empower financial institutions with 1-click checkouts, transaction alerts, and personalized offers-boosting upsell revenue by up to 62%.

Instant Payments

Pay EMIs, deposits, and bills easily

Drive Sales

Boost revenue with one-click options.

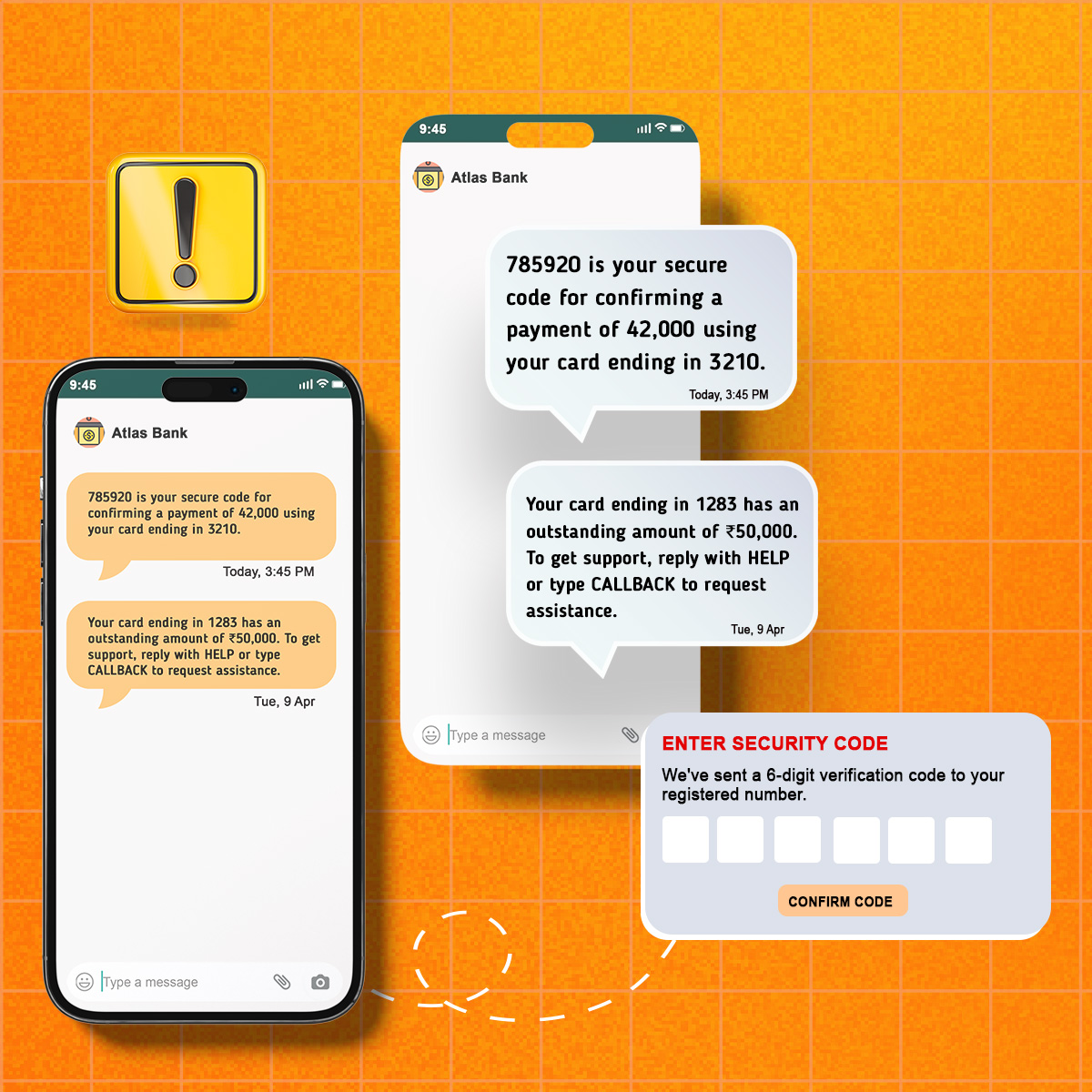

Improve Customer Support While Reducing Costs

- Automate up to 94% of customer queries using conversational channels and AI enabled chatbots, reducing wait times and support costs.

- Deliver real-time assistance via text, voice, or video channels for high-value, complex interactions using WhatsApp, SMS, and RCS messaging.

Instant Help with CPaaS

Solve 94% of queries instantly.

Quick support

Smooth transitions to live support.

Powering Banking & Finance with Smarter

Digital Solutions

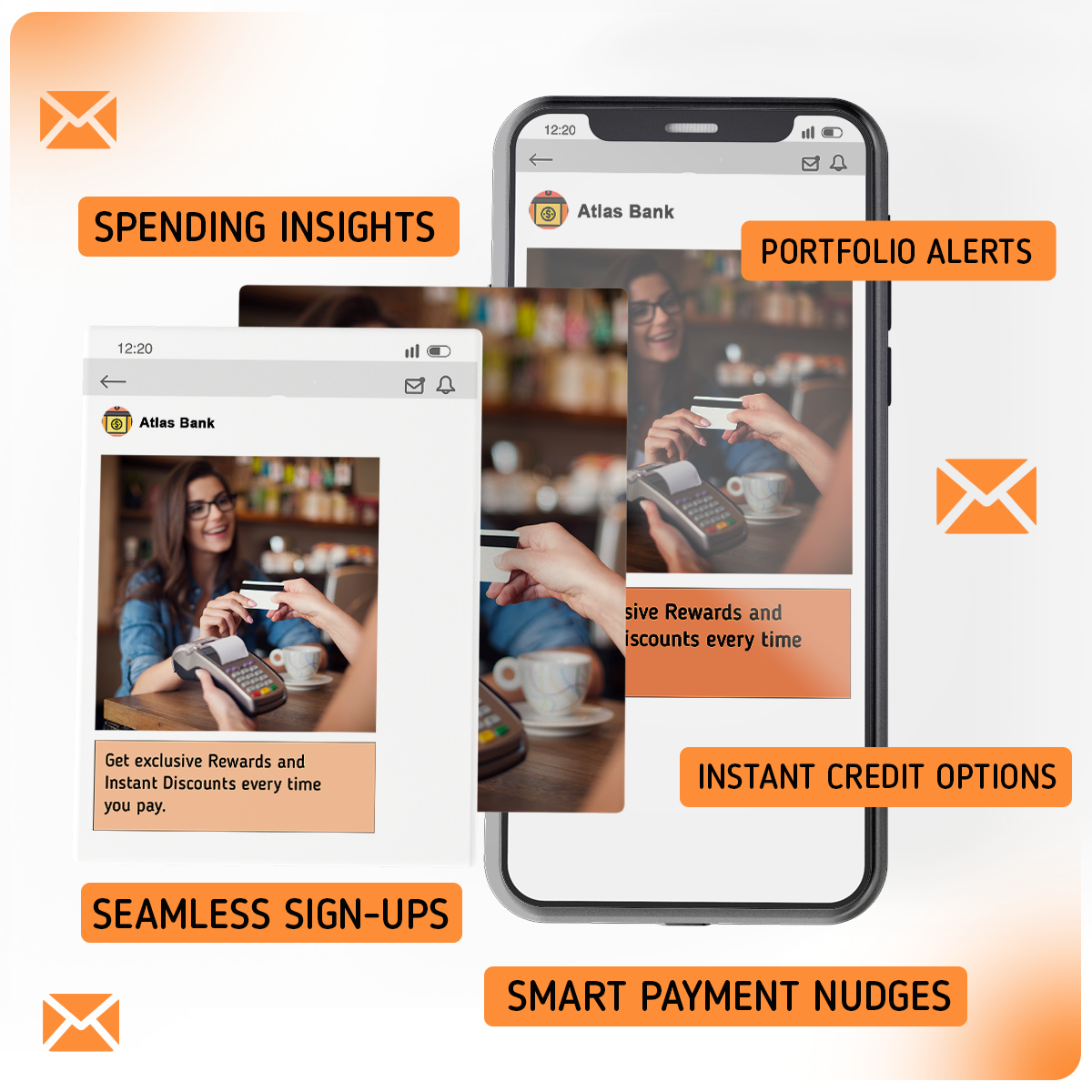

Omni Channel Reach

Reach customers on messaging channels, voice, and video. Offer better banking with integrated omnichannel support and Voice & Video AI.

Easy In-Chat Pay

Pay bills, EMIs, and more directly in chat. Making in-app payments a breeze for customers.

Simple KYC Process

Guided steps and online docs make digital KYC easy. Complete video KYC anytime, anywhere.

Your Smart Assistant

Get help in your own language. Enjoy secure, natural chats with your personal AI assistant.

Create Unique Journeys to Improve

Customer Experience

1. Retail Banking

Offer superior banking with 150+ pre-built flows. Effortlessly connect core, payment, and financial banking systems.

2. Capital Markets

We provide digital transformation alongside corporate strategy, market analysis, and operational improvements for lasting success.

3. Insurance

Simplify claims, policies, payments, and requests with pre-built journeys. Deliver easy-flow insurance processes.

4. Payments

Manage mobile recharge, renewals, utilities, reversals, and failures easily. Ensure satisfied customers with accurate payments.

5. Credit Union

Offer intelligent cross-selling, upselling, and 24/7 care in their language through our conversational app.

Establish Quick Integration with Different Apps and Online

Platforms to Provide Scalable Solutions

Business Transactions

Send precise and updated alerts of successful or failed transactions with automated services of nexG.

Customer Support

Organize customer interactions with the helpdesk dashboard to convert your conversations into tickets.

E-Commerce

Enhance your brand reach and customer experience to improve sales with easy e-commerce integration.

Automated Marketing

Transfer automated personalized messages, and target-specific information, analyze campaign performance via connected marketing tools integration.

Schedule Events

Help your clients schedule messages with categories such as type of event, date, occasion, time of delivery, and many more events.

Frequently Asked Questions

1. What exactly is a financial or banking chatbot?

A finance or banking chatbot is a computer program designed to simulate human conversations with customers and provide assistance with financial services. These chatbots use artificial intelligence (AI) to understand customer queries, respond with appropriate answers, and even make transactions. The technology behind finance chatbots enables them to learn from customer interactions, improving their accuracy and effectiveness over time.

2. What are the advantages of using a finance bot?

A finance bot can provide numerous benefits for both customers and financial institutions. For customers, it offers a convenient, always-available channel for transacting, seeking advice, and exploring financial products. For institutions, it can streamline operations, speed up transactions, reduce costs, and improve customer engagement and satisfaction.

3. What technology powers a BFSI chatbot?

Conversational AI technology powers BFSI chatbots. Using platforms such as nexG Platforms, financial institutions can build chatbots that support rich media, natural language processing, and machine learning. These chatbots can be deployed on a variety of channels, including text, voice, and video.

4. How do I create a personalised bot for my customer journeys?

nexG Platforms provides a no-code/low-code bot-building platform that enables financial institutions to build custom chatbots for their specific use cases. The platform offers pre-built templates, plug-in tools, and pre-trained models to streamline the process. The platform’s messaging API supports multiple messaging types and is easily configurable to integrate with existing systems.

5. What channels can I use to deploy conversational banking?

Conversational banking can be deployed on a variety of channels, including SMS, WhatsApp, Facebook Messenger, and more. nexG Platforms’ chatbot technology supports integration with over 15 messaging channels, allowing institutions to provide a seamless experience across multiple platforms. The platform’s AI technology ensures that the chatbot is trained to understand the specific terminology and context of each channel.