BFSI

Unleash AI Chatbots for Banking and Insurance Operations

Our platform provides over 150 pre-built conversational engagement journeys that can automate customer engagements across sales and support functions in a secure and scalable manner.

Trusted by Leading Brands

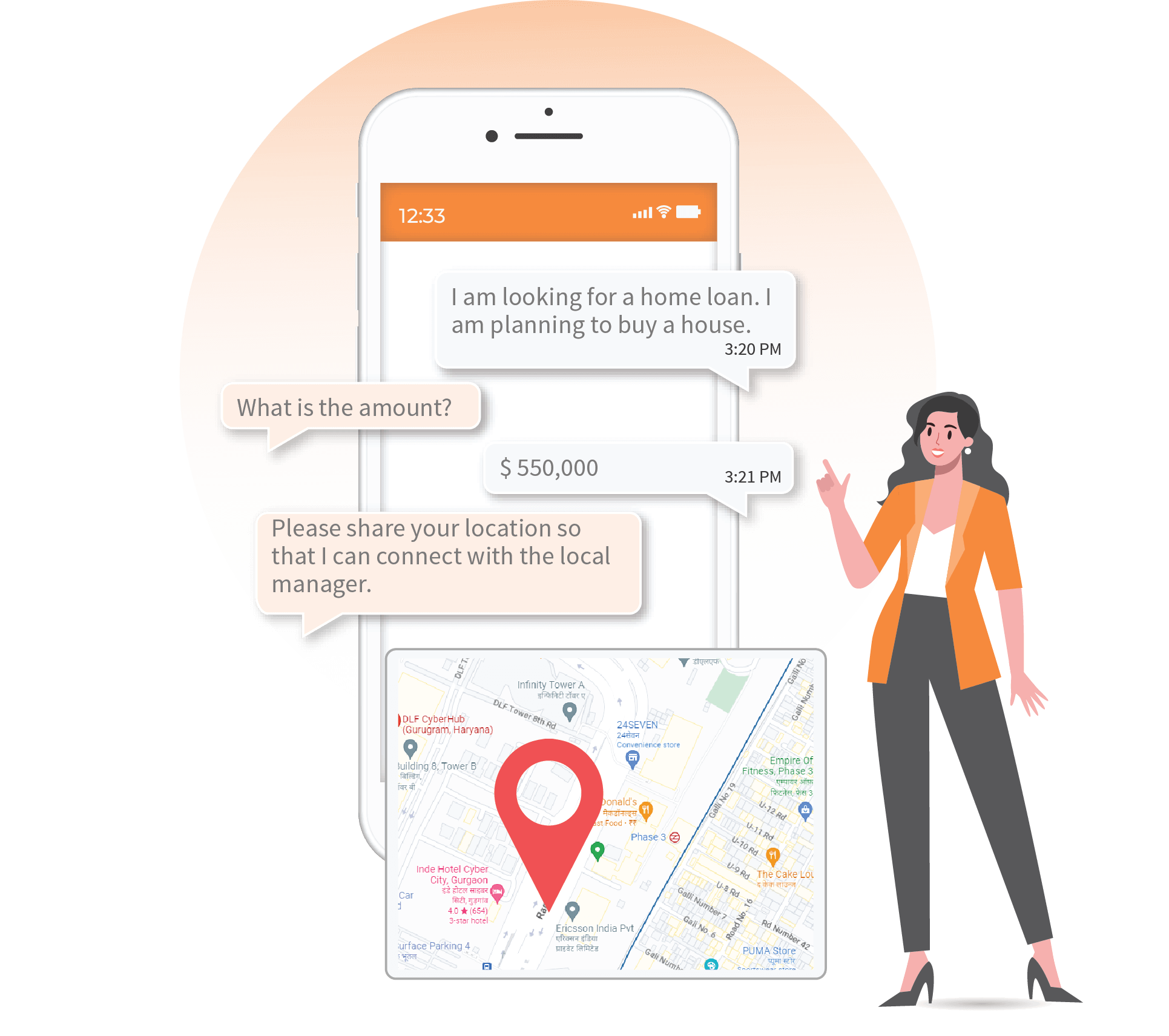

Digitally Onboard and Enhance

Customer Experience

- Discover products on WhatsApp with chat-based interface.

- Minimize abandonments and streamline onboarding.

- End-to-end digital KYC, onboarding, and activation services.

- Reduce onboarding time by 26%, for faster service.

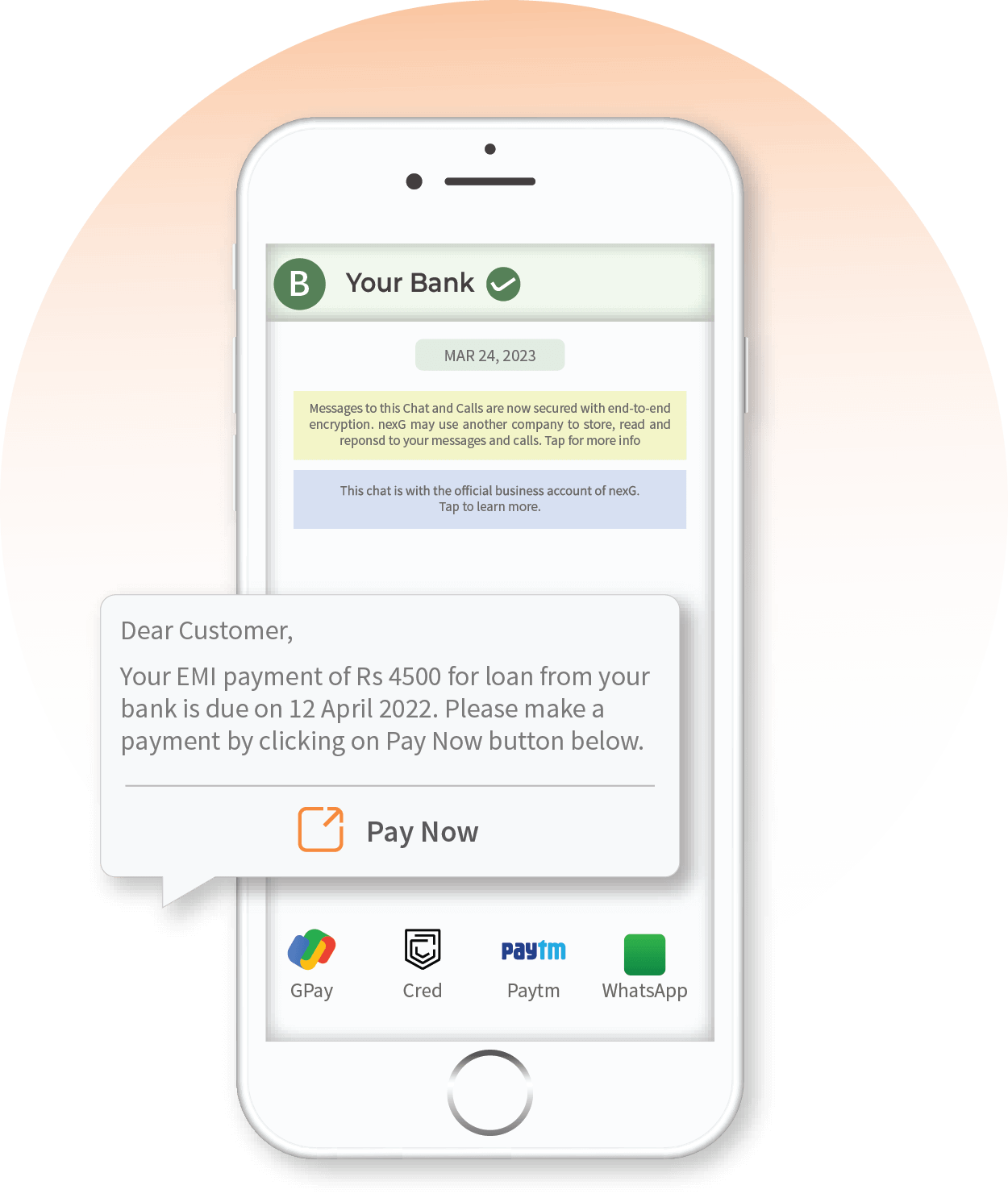

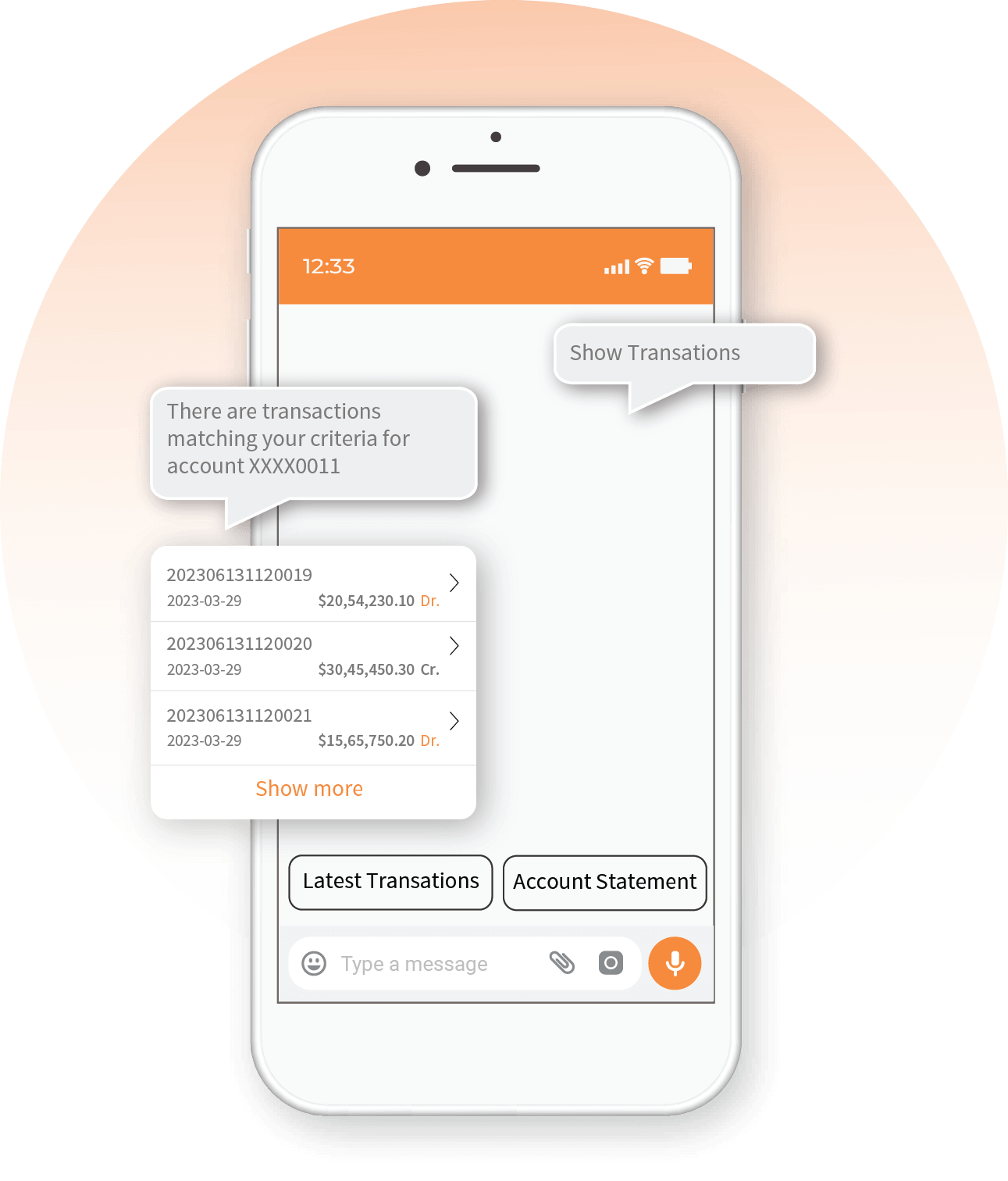

Grow Revenue,

Improve Relationships and

Transaction Solutions

- Chat-based payments for EMIs, premiums, stocks, and deposits.

- 1-click-bill pay feature for quick and secure transactions.

- Alerts, advice, offers, and comparisons to encourage customer action.

- 62% higher upsell and cross-sell revenue for increased customer value.

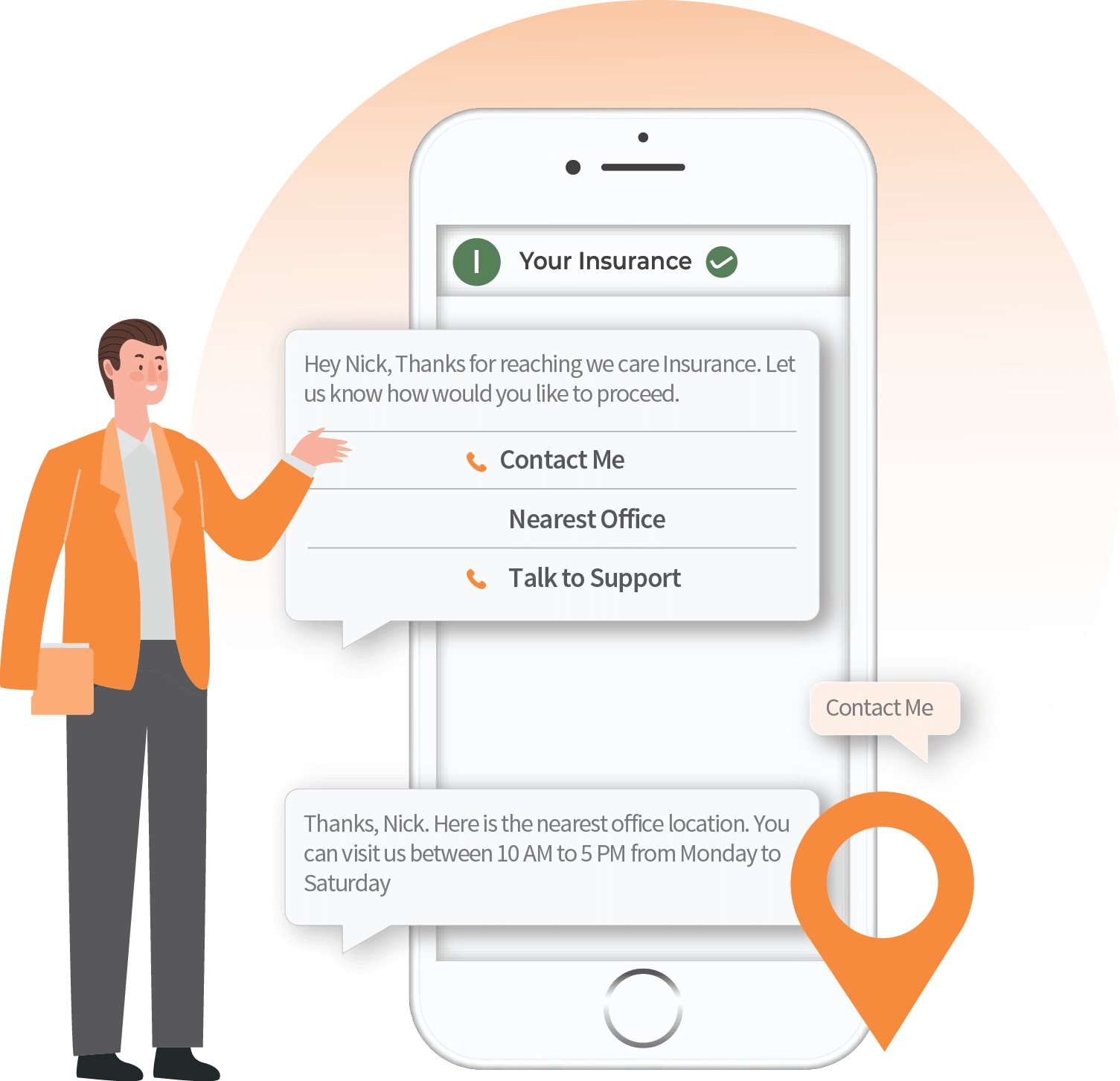

Enhance Support and Cut Costs

with Intuitive Solutions

- Pre-built journeys and automated FAQs reduce wait times and improve self-service options.

-

Businesses can humanize support with text, voice, and video interactions for complex queries.

- AI chatbots predict customer needs and aid Relationship Managers in cultivating profitable relationships.

- 94% of queries handled without human intervention saves costs and enhances customer satisfaction.

nexG Platforms Offers Unparalleled Abilities in Banking and

Finance with its Innovative Solutions

Our platform provides multichannel support for financial institutions by integrating with over 30 messaging channels through text, voice, and video, delivering a superior banking experience.

Our WhatsApp Banking solution offers customers 24/7 access to their accounts on their favorite messaging channel across the country.

Additionally, we incorporate Voice & Video AI into every customer touchpoint, including inbound and outbound calls, IVR, voice notes, and assistants.

With our Click Bill Pay feature, customers can easily make payments for bills, EMIs, and other purchases directly from the chat screen, streamlining the payment process.

We also simplify KYC with guided flows and online document collection, reducing effort and drop-offs with anytime video KYC.

Our AI Assistant provides a personal assistant that speaks the customer's language, offering secure, natural conversational experiences to enhance the customer experience.

With Unique Routes and Themes, You Can Transform

The Consumer Experience

Enhance your customers’ banking experience with our dynamic platform featuring over 150 pre-built journeys. Seamlessly connect with multiple core, payment, and financial systems across the banking, insurance, capital markets, and payments industries.

Revolutionize the brokerage industry with our next-gen platform, featuring journeys for stock quotes, market information, portfolio management, orders, equities, and mutual funds. Stay ahead of the competition and meet your customers’ needs with ease.

Streamline your insurance processes with our platform’s pre-built journeys for claims processing, policy management, premium payments, and service requests. Deliver a seamless experience to your customers and improve their satisfaction with your services.

Elevate your payment experience with our platform’s support for mobile recharge, subscription renewals, utility bill payments, incorrect debit reversals, and payment failure management. Keep your customers satisfied and ensure timely and accurate payments with our innovative solution.

Enhance engagement with credit union members through our conversational app, offering intelligent cross-selling, up-selling, and customer care 24/7 in their preferred language. Build stronger relationships with your customers and increase customer loyalty with our cutting-edge platform.

Establish Quick Integration with Different Apps and Online

Platforms to Provide Scalable Solutions

Business Transactions

Send precise and updated alerts of successful or failed transactions with automated services of nexG.

Customer Support

Organize customer interactions with the helpdesk dashboard to convert your conversations into tickets.

E-Commerce

Enhance your brand reach and customer experience to improve sales with easy e-commerce integration.

Automated Marketing

Transfer automated personalized messages, and target-specific information, and analyze campaign performance via connected marketing tools integration.

Schedule Events

Help your clients schedule messages with categories such as type of event, date, occasion, time of delivery, and many more events.

Frequently Asked Questions

A finance or banking chatbot is a computer program designed to simulate human conversations with customers and provide assistance with financial services. These chatbots use artificial intelligence (AI) to understand customer queries, respond with appropriate answers, and even make transactions. The technology behind finance chatbots enables them to learn from customer interactions, improving their accuracy and effectiveness over time.

A finance bot can provide numerous benefits for both customers and financial institutions. For customers, it offers a convenient, always-available channel for transacting, seeking advice, and exploring financial products. For institutions, it can streamline operations, speed up transactions, reduce costs, and improve customer engagement and satisfaction.

Conversational AI technology powers BFSI chatbots. Using platforms such as nexG Platforms, financial institutions can build chatbots that support rich media, natural language processing, and machine learning. These chatbots can be deployed on a variety of channels, including text, voice, and video.

nexG Platforms provides a no-code/low-code bot-building platform that enables financial institutions to build custom chatbots for their specific use cases. The platform offers pre-built templates, plug-in tools, and pre-trained models to streamline the process. The platform’s messaging API supports multiple messaging types and is easily configurable to integrate with existing systems.

Conversational banking can be deployed on a variety of channels, including SMS, WhatsApp, Facebook Messenger, and more. nexG Platforms’ chatbot technology supports integration with over 15 messaging channels, allowing institutions to provide a seamless experience across multiple platforms. The platform’s AI technology ensures that the chatbot is trained to understand the specific terminology and context of each channel.