Why Millennials Need Automation in Digital Banking

“Paise ka game hai, bhaiya!” For Indian millennials, managing money isn’t just about savings accounts and fixed deposits anymore. Millennials are a generation that has grown up with the internet and social media and are more likely to use mobile payment solutions for everyday transactions, such as paying bills, sending money to friends and family, and making online purchases. With digital as the go-to option for millennials, banking has also transformed into a fast-paced, 24/7 service. Did you know that millennials make up the largest demographic group in India, accounting for nearly 34% of the population? That’s over 440 million people [as per Freo]! Their sheer numbers and tech-savvy nature make them the prime audience for digital banking innovations.

Indian millennials, who contribute 44% of total lending in the country, are redefining both lending and payments categories. With growing comfort toward technology and digital tools, they expect faster, smarter, and more personalized banking solutions to meet their financial needs. As per The Economic Times, Indian millennials spend about 17 hours online weekly, with 11% of this time devoted to banking tasks like transactions and account management. Clearly, they prioritize superior customer experience and convenience delivered by digital banking.

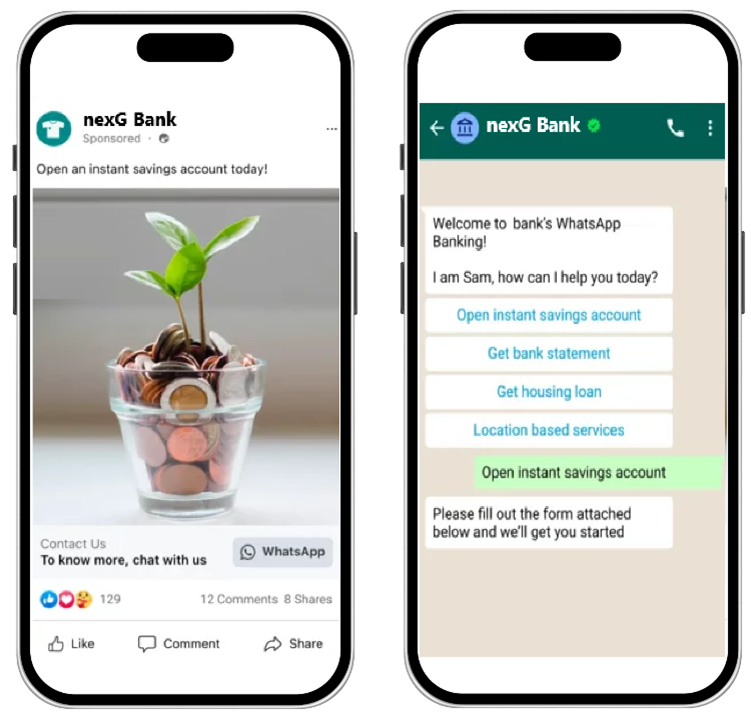

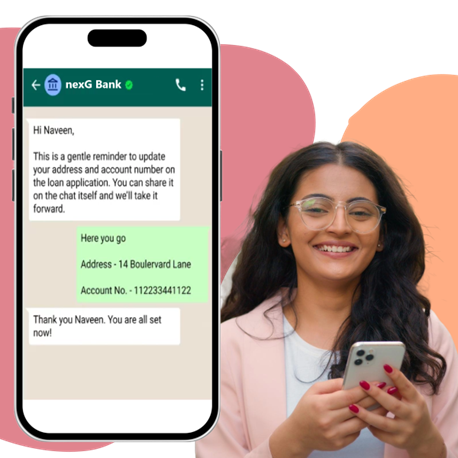

This is where personalized communication works like magic. By integrating the preferred mediums for millennials like WhatsApp, SMS, RCS into their banking experience, banks can simplify tedious and often manual processes like delivering personalized offers, seamless customer onboarding, digital loan approvals, fund transfers, and credit score checks. Automation ensures real-time responses, minimizes errors, and makes banking as easy as ordering food online. With automation, digital banking for millennials can transform into a seamless, enjoyable experience that meets their short-term and long-term financial goals.

CPaaS Solutions: Transforming Digital Banking Automation

Communication Platform as a Service (CPaaS) enables businesses to integrate real-time communication tools such as SMS, voice, chat, and video directly into their applications. For digital banking, CPaaS allows banks to provide a seamless, personalized experience by automating communication processes and enhancing customer engagement.

With CPaaS, banks can provide personalized banking for millennials by integrating communication tools directly into their apps and systems. Imagine receiving instant updates on your loan status, a chatbot assisting you with investment advice, or a voice assistant guiding you through your monthly budget—all in real-time.

Consider this real-life example of a millennial navigating digital banking:

Meet Aman, a 29-year-old working professional from Pune. He frequently juggles between his hectic work schedule and managing personal finances. One evening, Aman realizes he needs to transfer funds to a friend urgently, but it’s already past banking hours. With CPaaS solutions integrated into his banking app, Aman doesn’t have to worry.

- Personalized Offers: While chatting on WhatsApp, Aman receives tailored loan offers from his bank based on his spending habits and financial goals. The chat-based interface allows him to explore options, get instant clarifications, and apply for a loan seamlessly, all within the app

- Efficient Customer Support: As Aman faces an issue during the transfer, an AI-powered chatbot within the app guides him step-by-step, resolving the problem instantly without him needing to call customer service.

- Seamless Engagement: A push notification reminds Aman of his credit card bill payment, ensuring he avoids late fees. He completes the payment with just a few taps.

- Simplified Transactions: Thanks to CPaaS automation, the app’s one-click payment feature makes the fund transfer quick and error-free, even detecting and flagging potential fraud in real time.

For millennials like Aman, CPaaS transforms digital banking into a reliable, stress-free experience that fits seamlessly into their fast-paced lives.

How NexG Platforms Can Help Simplify Digital Banking

At NexG Platforms, we believe in empowering businesses to create meaningful and efficient customer interactions. For banks looking to capture the millennial market, we offer cutting-edge solutions that streamline communication and enhance automation.

Here’s how we can help:

- Personalized communication: With our intuitive UI, tailoring marketing messages and promotional offers based on customer data, delivering them through targeted channels is as convenient as 1,2,3

- Create an emotional connection: Banks can capitalize on the desire to form stronger emotional connections by offering real-life human interactions via audio and video chat features integrated into the banks mobile banking applications fostering real professional relationships and increasing client loyalty

- Using rich content: Banks can experiment with elements like buttons, rapid replies, product carousels, voice notes, images, and maps to deliver highly engaging banking conversations

- Digital Onboarding and Enhanced Customer Experience: Our solutions allow customers to discover products seamlessly right in their WhatsApp, RCS or SMS chat window, minimizing abandonments and streamlining onboarding. Banks can facilitate account verification and document collection for more customers in less time, boosting operational efficiency and growth.

- End-to-End Digital KYC and Activation Services: We provide a comprehensive digital onboarding experience that reduces onboarding time by 26%, ensuring faster service and activation.

- Boost Growth: By adopting CPaaS solutions, banks can transform their business strategies and unlock new growth opportunities. Automation enables banks to streamline operations, reduce manual errors, and offer faster, more personalized services. This enhanced efficiency allows banks to focus on acquiring new customers and retaining existing ones through superior customer experiences.

- Enrich Communication: From automated notifications to chatbots, we help banks maintain consistent and personalized communication with customers.

- Simplify Processes: By integrating automation into routine banking tasks, we make digital banking for millennials faster and more efficient.

- Enhance Customer Experience: Our solutions focus on millennials prioritizing the customer experience in banking, ensuring satisfaction at every touchpoint.

In today’s fast-paced world, the right automation tools can help banks stay ahead of fintech automation trends while addressing the unique needs of Indian millennials.

The Way Forward

With automation reshaping the landscape of digital banking, the future looks promising for Indian millennials. By simplifying processes, enhancing security, and delivering personalized experiences, banks can win the trust and loyalty of this tech-savvy generation.

As the backbone of India’s digital economy, millennials are not just consumers but active participants driving change. It’s time for banks to embrace innovative solutions like CPaaS and automation to meet their needs and exceed their expectations.

After all, “Millennials aur automation ka jod hai perfect blend, jo life banaye effortless end-to-end!”